Fundamental valuation, mining, market capitalization

“Crypto Valuation: A Guide to Fundamental Analysis in a Decentralized World”

The world of cryptocurrencies has grown exponentially over the past decade, attracting investors and enthusiasts alike with the potential for high returns. However, amidst all the hype, one key aspect is often overlooked: fundamental valuation. In this article, we’ll delve into the basics of fundamental analysis as it relates to cryptocurrencies, exploring how to evaluate market capitalization (market cap), mining costs, and other key factors that can influence a coin’s value.

What is fundamental valuation?

Fundamental valuation is the process of estimating the intrinsic value of a company based on underlying financial metrics such as revenue, earnings per share, debt-to-equity ratio, and market capitalization. In the context of cryptocurrencies, fundamental analysis involves examining the historical performance of coins, market trends, and other relevant factors to determine their potential value.

Market Capitalization

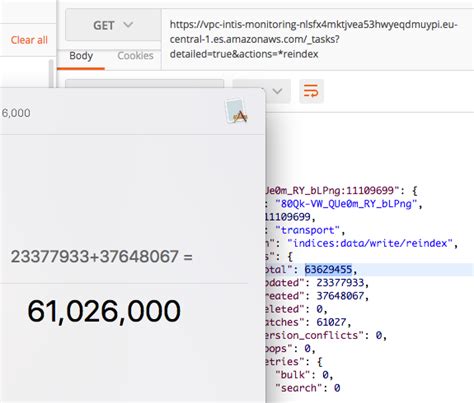

Market capitalization is a key metric when valuing cryptocurrencies. It represents the total value of all outstanding shares in a company’s capital structure. The following formula is used to calculate market capitalization:

Market Cap = Total Shares Outstanding x Current Market Price per Share

For example, if Bitcoin has 18 million outstanding shares and its current price is $30,000, its market capitalization would be:

Market Cap = $18,000,000 x $30,000 = $540 billion

A higher market capitalization indicates more liquidity and potentially greater stability in the market.

Mining Costs

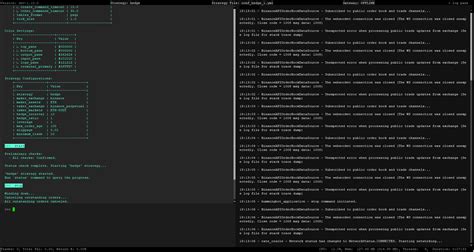

Miners play a crucial role in securing the cryptocurrency network by validating transactions and maintaining the integrity of the blockchain. However, mining costs can significantly affect the value of a coin. The cost of computing power required to mine a given coin is directly proportional to its market value.

In other words, coins with higher market capitalizations require more powerful computers to solve complex mathematical equations, which increases electricity consumption and generates more revenue for miners. This can lead to increased competition among miners, which can result in lower prices or even a price drop if demand exceeds supply.

Other Key Factors

There are other factors that come into play when assessing the fundamental value of a cryptocurrency:

- Supply and Demand: The balance between buyers and sellers determines the market price. Coins with high demand and limited supply tend to be more valuable.

- Regulatory Environment: Government regulations can significantly affect the acceptance and value of coins. Cryptocurrencies operating in countries with favorable regulatory environments tend to have higher values.

- Adoption Rate: As more users join the cryptocurrency network, its market capitalization increases, which increases prices.

- Network Effect: The more users there are on the network, the more valuable a coin becomes.

Conclusion

In summary, fundamental evaluation is essential to understanding the potential value of cryptocurrencies. By evaluating key metrics such as market capitalization, mining costs, and supply and demand dynamics, investors can make informed decisions about which coins to invest in or hold for the long term. While there are no guarantees, a thorough analysis of these factors can help cryptocurrency enthusiasts navigate the complex world of decentralized assets.

As the cryptocurrency landscape continues to evolve, fundamental analysis remains a key aspect of investment strategies. By staying up to date with market trends and adapting our approaches accordingly, we can successfully position ourselves in this rapidly changing environment.