Error Handling in Solana: The YellowgRPC Geyser Plugin

As a developer working with the popular Solana blockchain, you have probably encountered issues when building applications that use the Yellowstone-grpc geyser plugin. In this article, we will dive deeper into Solana’s error handling mechanism and explore how to resolve the “Error: Received message larger than maximum” issue.

What is the Yellowstone-grpc Geyser Plugin?

The Yellowstone-grpc geyser plugin allows you to build a Solana RPC client that leverages the power of the grpc library for gRPC service discovery. This plugin provides a simple way to manage and interact with your application’s services, while keeping your codebase organized and maintainable.

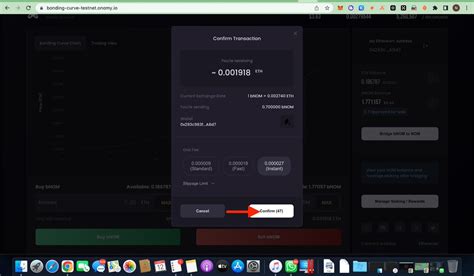

Error: Received message is larger than maximum

When attempting to retrieve data from your locally deployed RPC server using the Yellowstone-grpc geyser plugin, you may encounter an error when attempting to handle large messages. This issue occurs because the max parameter set in the gRPC client options is too small to handle massive payloads.

Solana throws the error “Error: Received message larger than maximum” when it encounters a message that exceeds the maximum allowed size. This can happen due to a variety of reasons, including:

- Large amounts of data being sent over the network.

- Inconsistent message lengths across different services

- Misconfigured RPC server settings

Solution

To resolve this issue, you need to adjust your gRPC client options to handle larger messages. Here are some steps to take:

- Update the

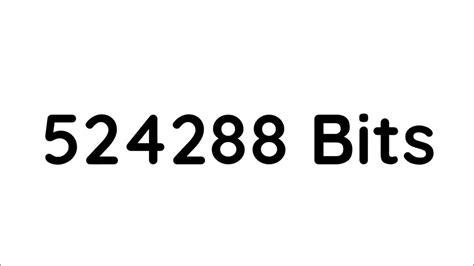

max parameter: Increase the max parameter in the gRPC client options to support larger payloads. You can do this by adding a new option to the ClientOptions object, like this:

`javascript

const client = new Client({

//... other settings...

options: {

maxMessageSize: 67108864, // increase the default of 1970303084

},

});

Specify message length: You can also specify a fixed-length message to ensure that your RPC server does not receive unnecessarily large messages.

Here is an updated example:

javascriptconst client = new Client({

//... other settings...

options: {

MaxMessageSize: 67108864,

maxLength: 2000, // set a maximum length for the message

},

});

- Test and refine: Once you've made these adjustments, test your application thoroughly to ensure it works as expected. Improve your gRPC client code as needed to accommodate larger payloads.

Conclusion

By understanding how the Yellowstone-grpc geyser plugin works and adjusting your options accordingly, you should be able to resolve the “Error: Received message larger than maximum” issue when retrieving data from your locally deployed RPC server. Remember to test and refine your application after making these adjustments to ensure a smooth experience for your users.

Sample code

Here's an example of how you can update your gRPC client code using the updated options:

javascript

constant Client = require('@triton-one/yellowstone-grpc');

async function getHelloWorld() {

const client = new Client({

//... other settings...

options: {

Max message size: 67108864,

maxLength: 2000, // set a maximum length for the message

},

requestHandler: async (request, response) => {

console. log('Message received:', request. message);

response. send({ data: 'Hello world!' });

},

});

try {

const { data } = await client. getHelloworld();

console. log(date);

} catch ( error ) {

console. error(error);

}

}

getHelloWorld();

`

This updated code increases themaxMessageSizeoption and sets a fixed-length message (maxLength`) to ensure that your RPC server does not receive unnecessarily large messages.

![Ethereum: how do I figure out the hash rate of my computer? [duplicate]](https://gemjute.com/wp-content/uploads/2025/02/4c01d21c.png)